A Property blog by Paul Bennion.

Property investors with units and apartments in most capital cities in Australia are achieving rental yields of more than 5 per cent.

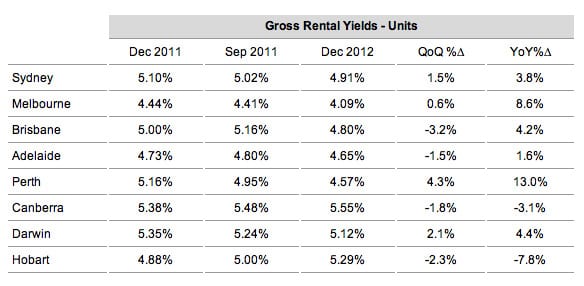

December 2011 figures from Australian Property Monitors show that in the past year gross rental yields for units in Perth, Brisbane and Sydney have delivered above 5%, joining Darwin and Canberra with high performing rental yields for this type of property.

Despite recording year on year growth of over 8%, gross rental yield for Melbourne units was the lowest for December 2011 at 4.44%. Adelaide and Hobart also reported rental yields below 5% for the same period.

At the other end of the spectrum, Canberra has continued to perform strongly, recording the highest rental yields for units and apartments in December 2011 at 5.38%, followed by Darwin (5.35%), Perth (5.16%), Sydney (5.10%) and Brisbane (5.00%). During 2011, Perth recorded the largest increase in rental yields for units and apartments, growing by 13% year on year.

Paul Bennion, Managing Director of DEPPRO, Australia’s leading depreciation company, said the figures are significant particularly because investors generally favour units and apartments over houses as a property asset.

“Historically when rental yields rise above 5%, investors start to move back into the real estate market because investment properties are moving towards a break-even cost benefit,” Bennion said.

Good rental return gives buyers more confidence in the investment property market and is generally thought to be a good indicator of a property’s potential.”

Bennion also added that in order to further improve return on investment, investors should obtain a depreciation schedule for their property and ensure they claim their full tax depreciation benefits.